Embedded finance software platform

Integrate financial services with embedded finance software platform. Create wallets, optimise cost of purchases and refunds, enable loyalty programs and more.

Modern cost-efficient cloud-native software platform

for fintech companies and banks.

Complete software toolkit for wallet & e-money projects.

Software-as-a-Service and on-premise deployment available.

Veengu provides its software as SaaS and as software license for on-premise deployment.

For quick launch enroll to our SaaS platform as a licensed fintech provider, integrate with your partners, apply your brand book and go. Pay monthly.

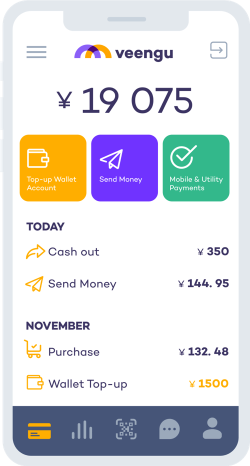

Provide your end users with means to access a range of financial services - from peer-to-peer transfers to loans and asset management.

Connect consumers, merchants, agents, enterprises into a multi-role payment ecosystem.

Enable business-to-business transfers and payroll. Issue subsidized wallets for food and fuel.

Enable stored value and payment services for your customers to facilitate the payment process.

Most e-money projects require significant capital investment into heavyweight software platforms, infrastructure and vendor implementation services.

Veengu solves this problem. We offer an end-to-end 24/7 secure software platform with ready-made mobile apps and portals for end users, as well as back office for service provider operations.

Developer portal and a public API with over 140 instantiated methods for managing users and services.

Secure deployment in Amazon (AWS) cloud tailored for financial services.

Ready-made functional packages grouped into selectable and configurable features

Encrypted storage of personal data, access credentials management and audit trails

Scalable distributed architecture and a high-performing transactional engine

24/7 availability, up to "five nines" uptime

Integrate financial services with embedded finance software platform. Create wallets, optimise cost of purchases and refunds, enable loyalty programs and more.

Statistics, analytics, reports about financial inclusion in the Middle East and North Africa. Current challenges and opportunities. Veengu software for fintech services in the MENA region.

Veengu cross-border transfer software covers multi-party orchestration, online currency conversion, compliance, risk management, white-label solutions – setting a new standard for efficiency and reliability in global transactions.