White Label Mobile Wallet

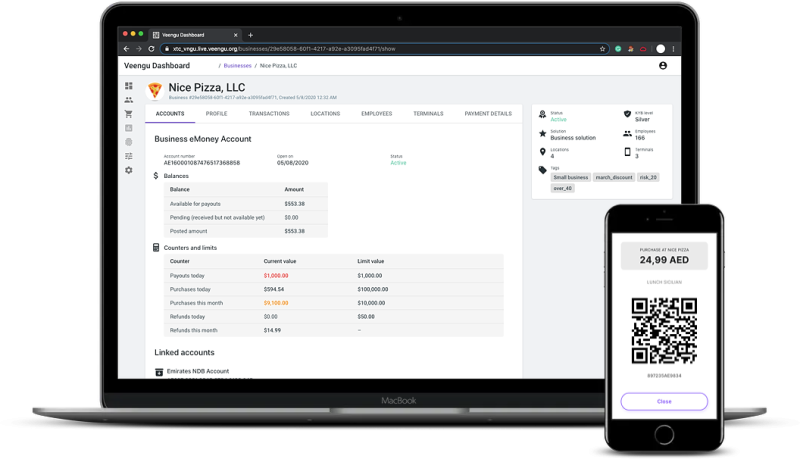

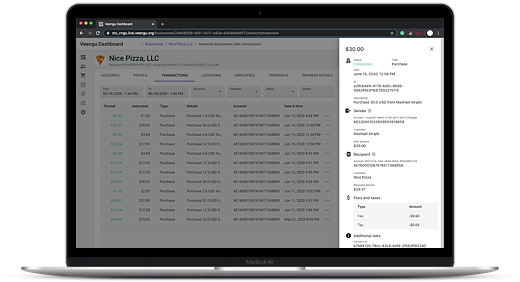

Platform for transactions between buyers and sellers, individuals and businesses. E-money deposit and withdrawal, instant P2P payments, QR and NFC purchases, transfers to third parties and payouts.

We deliver payments infrastructure for different cases. You save money keeping community, business or marketplace funds within this ecosystem.