In some countries in Africa, Asia, and the Middle East, many people still lack access to banking services, hindering economic progress. Agents have emerged as a solution, acting as intermediaries to bring banking services closer to local communities. The Veengu app for agents enables agent banking implementation, making it easier and more efficient to serve the unbanked population.

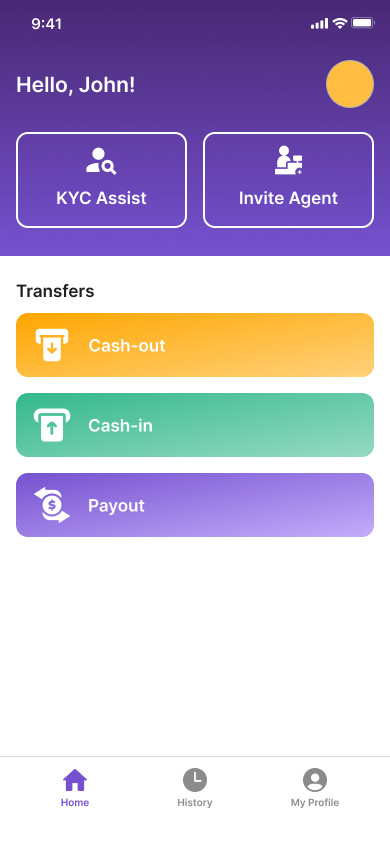

Veengu App Functions for Agents

Onboarding New Customers:

The Veengu app simplifies the process of registering and onboarding new customers, enabling agents to expand their network swiftly.

Assisting New Customers with KYC:

Agents can assist new customers in completing the Know Your Customer (KYC) process using the Veengu app, ensuring compliance with regulations and making it easier for individuals to access banking services.

Cash Withdrawal:

The app enables agents to offer cash withdrawal services, allowing customers to access their funds conveniently without the need for a traditional bank branch.

Cash Deposit:

Agents can facilitate cash deposits through the Veengu app, making it easier for customers to save money securely.

Cash Payout by Code:

With the Veengu app, agents can perform local and cross-border cash payouts, enabling customers to receive money quickly and safely.

Agents, supported by the Veengu app, are transforming banking accessibility in countries with large unbanked populations. By providing essential services like customer onboarding, cash withdrawal, deposits, and secure cash payouts, the Veengu agent app is instrumental in expanding financial inclusion and driving economic growth in the region.