History of Core Banking Systems

Core banking systems serve as the backbone of financial institutions, enabling crucial functions like transaction recording, account management, and product development. Over the years, these systems have evolved through various generations, adapting to technological advancements and changing customer demands.

Before we start a comparison of the modern core banking and previous core banking generations we’d like to provide except for the article “#17 Core Banking Platforms” published by Frontier Fintech Newsletter.

Evolution of Core Banking Systems: The first-generation core banking systems were built on mainframe server technology, revolutionizing banking by allowing customers to transact across multiple branches. Subsequently, the second generation emerged in the 70s and 80s to incorporate additional channels like ATMs and telephone banking. However, it was the third generation, emerging in the 1990s, that marked a significant shift. These systems were written in more modern programming languages and relied on application servers, yet they still ran batch processes and were monolithic in nature.

Challenges Faced by Legacy Core Banking: As technology continued to advance, customer demands evolved with the explosion of mobile and internet banking in the 2000s. Banks resorted to workarounds to meet these demands, leading to increased complexity, data silos, higher costs, and technical debt. This necessitated the development of fourth-generation core banking systems, characterized by cloud-native architecture, micro-service frameworks, and enhanced data capabilities.

Main Approaches to Modern Core Banking

In the same article, Samora Kariuki discusses four main approaches to core banking transformation in the era of modern cloud computing and big data:

- Composable Banking:

- This approach leverages APIs and cloud-native technology to deliver core banking systems via the SaaS business model. Leaders like Mambu focus on customer data, ledgers, and product factories, with integration connectors for best-of-breed providers.

- Self Build:

- Some institutions, including neobanks like Monzo, Nubank, Starling, and Revolut, opt to build their own core banking platforms. This decision is driven by the need for flexible scalability, high reliability, and robust payment capabilities.

- Traditional Vendors:

- Established players like Oracle Flexcube, Finacle, Temenos, and Fiserv have upgraded their platforms to be cloud-native. However, concerns exist regarding their optimization for different deployment environments.

- Modern Core Banking Providers:

- Emerging since around 2017, these providers capitalize on concepts like open banking, cloud computing, and banking as a service. They offer micro-service architecture, data streaming, cloud-native operation, and a SaaS business model.

Modern Core Banking Platform by Veengu

Veengu is one of the modern core banking providers in the market.

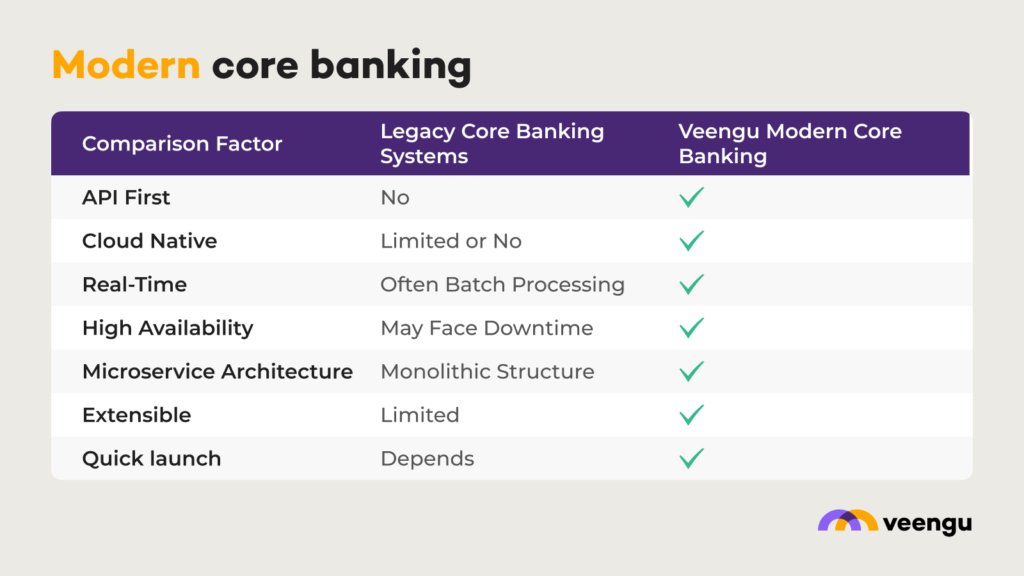

Comparison Table: Veengu Modern Core Banking vs. Legacy Core Banking Systems

| Comparison Factor | Veengu Modern Core Banking | Legacy Core Banking Systems |

|---|---|---|

| API First | Yes | No |

| Cloud Native | Yes | Limited or No |

| Real-Time | Yes | Often Batch Processing |

| High Availability | Yes | May Face Downtime |

| Microservice Architecture | Yes | Monolithic Structure |

| Extensible | Yes | Limited |

| Quick launch | Yes | Depends |

Exploring the Distinctions:

- Component-Based:

- Veengu employs a component-based architecture, allowing for modular customization and seamless integration of new features or services.

- Legacy Systems often lack this modular approach, making it challenging to introduce new functionalities without extensive redevelopment.

- API First:

- Veengu is designed with an API-first approach, ensuring easy integration with external systems, fintech applications, and third-party services.

- Legacy Systems may have limited API capabilities, potentially hindering interoperability.

- Cloud Native:

- Veengu is built with cloud-native principles, enabling easy scalability, robust security, and efficient resource utilization.

- Legacy Platforms may not be designed for cloud environments, potentially limiting scalability and cost-effectiveness.

- Real-Time:

- Veengu operates in real-time, ensuring immediate transaction processing and up-to-date information for customers and banking staff.

- Some Legacy Systems rely on batch processing, leading to delayed transaction updates and slower response times.

In conclusion, the choice between modern and legacy core banking systems depends on various factors, including a bank’s specific needs, scalability requirements, and technological capabilities. Embracing modern core banking solutions can empower financial institutions to stay agile, competitive, and future-ready in the rapidly evolving financial landscape.