For ages, banks are obliged to know information about their clients. Bank typically requested its branch visitor to provide any kind of personal ID and additional information like address and birth date. Today we know this regulatory requirement as KYC and it is an important element in the fight against financial crime. Personal or company identification helps a financial institution to ensure that its customers are really who they are claiming to be. Usually, financial institutions as banks and e-money institutions must identify their customers before carrying out any financial transaction. KYC and AML processes help a fintech company to understand better its clientele, monitor financial transactions, reduce financial and regulatory risks, prevent bribery and corruption.

Basic KYC procedures consist of client identification procedures, that may be followed by further tracking of customer’s transactions in parallel with risk management and fraud prevention processes. Just manual reviewing of each customer’s profile by the in-house financial organization team proved its inefficiency a long time ago. Today by utilizing document OCR (Optical Character Recognition), face liveness checks, automated integrations, and decision making, the KYC process becomes more efficient, quick, and reliable.

How does Veengu support KYC processes?

Profiles

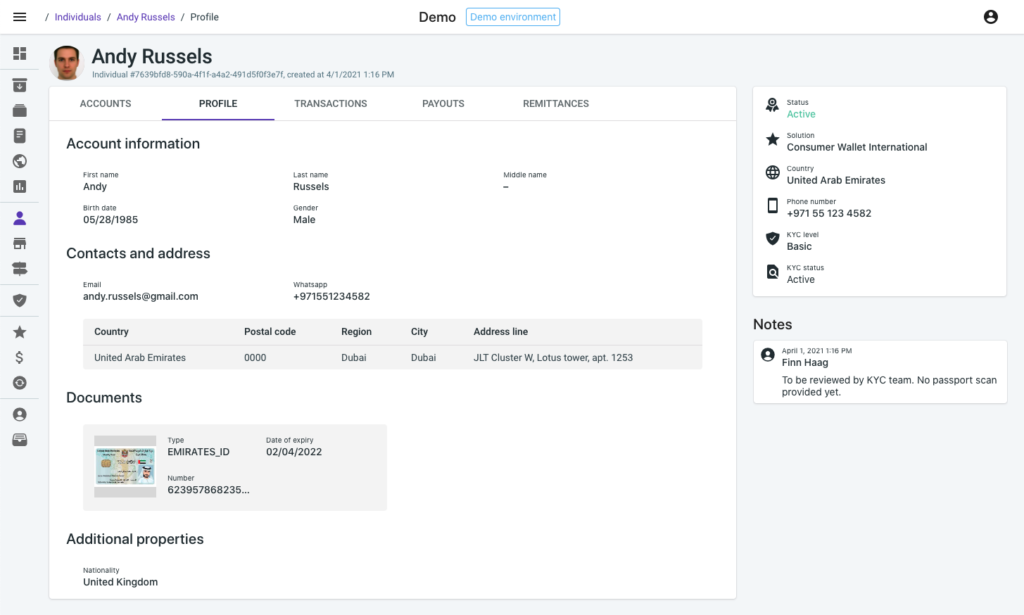

Veengu platform stores and manages end-user profiles – both companies’ and individuals’. All necessary customer information is stored, updated, and managed within the software. Documents and photos are part of the profile too. To ensure data protection some key data fields are not available for all back-office clerks.

End-user onboarding

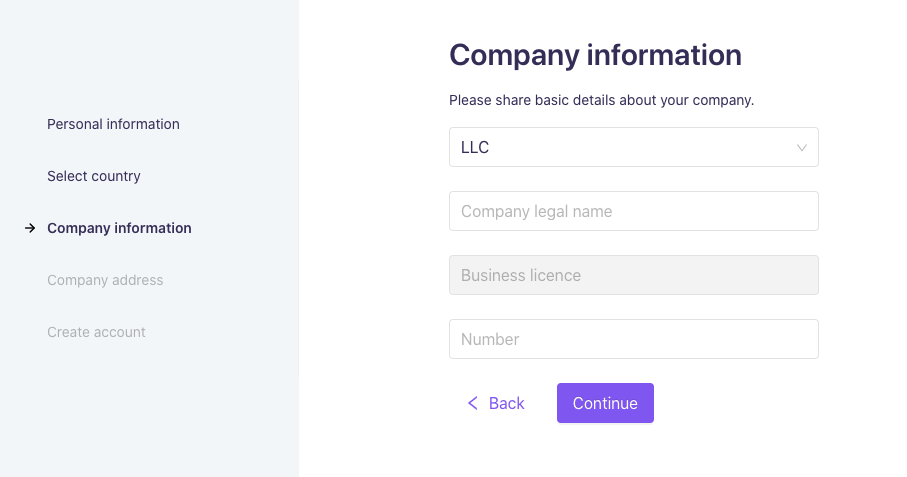

Veengu provides intuitive user interfaces to capture end-user data, including demographic fields, scans of documents, and selfies as part of self-onboarding or onboarding via Veengu dashboard by a back-office clerk. End-user onboarding may include automated data extraction from documents by a third-party OCR SDK or address verification via online integration with government services.

KYC workflows and case management

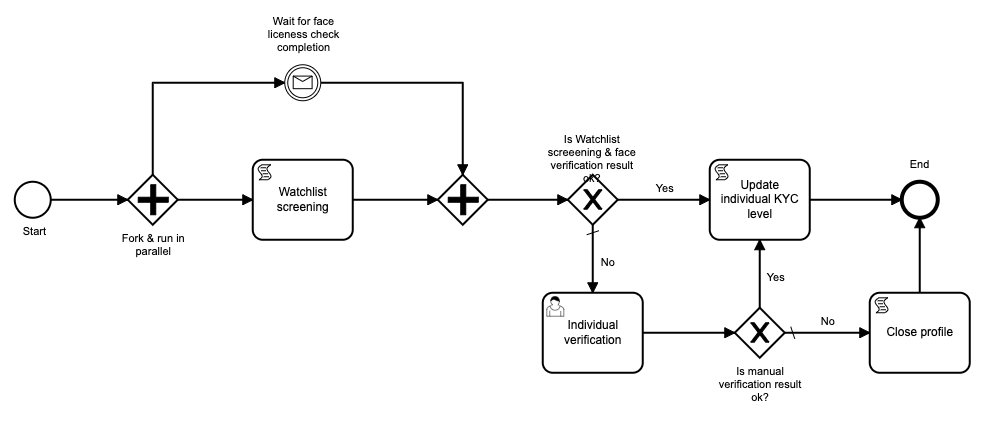

When a request for end-user onboarding comes to Veengu, the system may create the profile automatically, however, in most cases, the request goes through the configured workflow. The KYC workflow may consist of multiple steps and routes depending on the data received with the initial request and data gathered from third parties as part of workflow execution. Veengu workflows engine allows to set up a variety of verification rules for further automated execution.

Usually, we customize workflow to reflect the fintech organization’s policies and applicable regulatory requirements. We can set up different flows for different types of end-user based on residency, phone number, or other parameters. Any automated processing may have exceptional cases and Veengu workflow can also switch to manual decision making.

Sanctions and PEP screening

Veengu can integrate with providers of the PEP (Politically Exposed Persons) lists, sanctions lists, negative media screening, etc. We recommend financial organizations to connect to online services that gather information from reliable and reputable sources – such as local or international watch lists, government records, and media searches. It helps a fintech to identify high-risk PEPs, fraudsters, criminals, and terrorists.

Other KYC features

Veengu platform can generate regulatory reporting on customer onboarding and perform ongoing monitoring of existing customers. It’s important to mention that all KYC actions are recorded in an immutable audit trail.

Summary

A financial institution shall and have effective verification workflows to make informed decisions with reasonable onboarding conversion rates. Veengu helps fintech to orchestrate its KYC compliance and meet regulatory obligations. Veengu can help you automate the onboarding and monitoring of your end-users. Veengu system will centralize all the key KYC functions of gathering documents, data assessment, case management, regular rescreening, and reporting within one software solution. Your compliance team will make KYC decisions faster and more cost-efficiently.