In banking, a “system of record” refers to a centralized database or platform that serves as the authoritative source of data for a particular type of information within an organization. It is the primary repository where critical and official data related to various banking operations and transactions are stored.

The system of record for fintech is designed to ensure accuracy, consistency, and reliability of data. It is typically used to manage essential information such as customer account details, transaction history, balances, and other financial records. This system is crucial for regulatory compliance, financial reporting, and auditing purposes.

For example, in a bank, the core banking system is often considered the system of record for customer accounts. It maintains up-to-date and accurate information about account balances, transaction history, and other relevant details.

When it comes to choosing a system of record for fintech, there are several well-known options in the market. Some of the notable contenders include solutions from Oracle Financial Services, FIS, and Temenos. Each of these solutions comes with its unique features and benefits, catering to different aspects of banking and fintech operations.

In recent years, Veengu has emerged as a standout choice, offering a range of features that make it an exceptionally well-suited system of record for fintech companies.

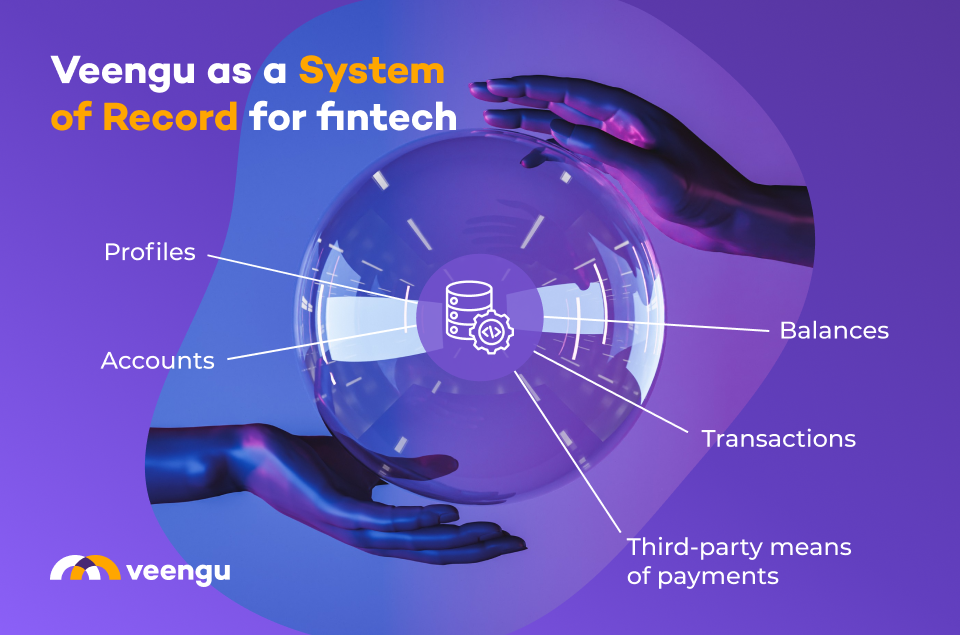

Veengu is a core banking system for fintech companies. It provides a centralized repository for customer data, empowering fintech companies to efficiently manage and access critical information, such as customer profiles, accounts, transactions, and more.

Why is Veengu the top choice as a system of record for fintech?

Here are compelling reasons why Veengu is a top choice system of record for fintech companies:

- Data validation, accuracy and integrity.

- Scalability. Veengu can scale to meet your needs, ensuring uninterrupted service and performance.

- Security: encryption and access control measures to shield sensitive financial data from unauthorized access and cyber threats.

- Regulatory compliance: Veengu is purpose-built with compliance in mind. It simplifies adherence to industry-specific regulations and reporting standards.

- Real-time data accessibility, enabling your team to access up-to-the-minute information, which is essential for customer applications, risk management, and customer support.

- Veengu is designed with open APIs and integration capabilities, ensuring compatibility with various third-party applications and services.

By implementing Veengu as your system of record, you position your fintech company for success, enabling you to meet customer expectations, comply with regulatory requirements, and stay at the forefront of the ever-evolving world of financial technology.

Comparison of Veengu with cloud-native core banking platforms

Now let’s compare Veengu with other modern, cloud-native core banking platforms in the fintech industry like Thought Machine and Mambu.

Here’s why Veengu considered the best system of record for fintech and a great core banking platform for fintech:

- Cloud-Native Advantage: Veengu operates entirely in the cloud, which means it leverages the latest development frameworks right from the start. Unlike traditional software houses that may have legacy systems to manage, Veengu doesn’t have to deal with the complexities of previous migration journeys. This allows for more agile and efficient development.

- No Legacy Burden: By following a ‘no legacy’ principle, Veengu can utilize modern solutions like smart contracts and real-time data without the traditional cost burdens associated with code development. This leads to cost-effective and faster deployment of financial products.

- Real-Time Insights: Veengu is capable of providing real-time insights not only to customers but also to downstream systems, including regulatory reporting outputs. This ensures accurate and up-to-date information about customer accounts and business lines at any given time.

- Strong Engineering Team: Veengu boasts one of the best engineering teams in the industry, consisting of experts from both the banking community and leading technology players. This blend of talent ensures that the platform is equipped to handle the evolving needs of the fintech industry.

- API-First Approach: Modern API’s are crucial in a digital financial ecosystem. Veengu ensures that there are APIs for every aspect of the account journey, from creation to dormancy to closure. This allows for seamless integration with other services and applications.

- Scalability and Robustness: The scalability and robustness of Veengu’s APIs are rigorously tested through automated processes. This ensures that the platform can handle increasing demands and maintain a high level of performance.

- Componentization and Containerization: Veengu supports componentization and containerization, allowing for the modular deployment of functionality. This means that basic features can be quickly implemented, and new functionalities can be added based on evolving business needs.

- Avoiding Vendor Lock-In: Veengu encourages the review of vendor lock-in, whether it’s related to hardware or cloud providers. This ensures that banks and fintech companies have the flexibility to adapt to changing technology landscapes.

- Compatibility with Open Source Platforms: Veengu is compatible with open source databases, event architecture, and API management. This aligns with the industry trend towards open-source solutions, providing more flexibility and customization options.

In summary, Veengu stands out as a best system of record for fintech and core banking platform for fintech due to its cloud-native architecture, real-time capabilities, strong engineering team, API-first approach, and compatibility with modern technologies. It offers a forward-looking solution that addresses the evolving needs of the fintech industry.