Embedded finance software platform

Integrate financial services with embedded finance software platform. Create wallets, optimise cost of purchases and refunds, enable loyalty programs and more.

Cloud, open technology based, modern and cost-efficient Core Banking System for Fintech, neobanks, EMIs, money transfer services, PSPs crafted to provide seamless and secure financial operations, enabling fintech companies to thrive in the digital era.

With Veengu at the heart of your banking architecture, you gain an open and composable technology foundation. This allows you to craft customer-centric experiences under your complete control. Our extensive partner ecosystem connects you to independent services, enabling the creation of unique financial offerings.

Veengu’s financial core offers unparalleled flexibility and control in designing and building new financial products. Whether it's innovative offerings like multi-currency accounts or replicating products from legacy platforms, Veengu ensures a seamless migration process without disrupting existing product sets.

Compete with agility using Veengu. Our rapid deployment ensures go-lives in weeks and months, not years. Future-proofed with a single code base, publicly available APIs, and regular releases, Veengu allows you to iterate continuously with zero disruption.

Veengu is cloud-native with a transparent SaaS model. It scales effortlessly with your growth, eliminating heavy upfront investments, vendor lock-ins, and costly professional service engagements. Experience a cost-effective digital transformation.

Veengu's pre-built connectors grant you comprehensive control over your data and solutions without the need for manual integration. These integrations are constantly refreshed to keep you ahead.

Veengu provides banks complete control over data management with its real-time Accounts and Transaction Ledger. Supporting multiple banks, currencies, and operations, it offers rich data streaming for AI and reporting. Personalize propositions for customers using AI-driven insights.

Veengu’s Process Engine automates banking and fintech processes, enabling a streamlined and efficient operational model.

Veengu is committed to delivering reliable, future-proof tech solutions for financial services companies. Our microservices infrastructure ensures flexibility, customization, and seamless integration.

Our comprehensive software suite, designed for different verticals in the financial services industry, is configurable to implement your vision with our tech and professional services.

Build unique fintech solutions across the world with our modular cloud-native platform.

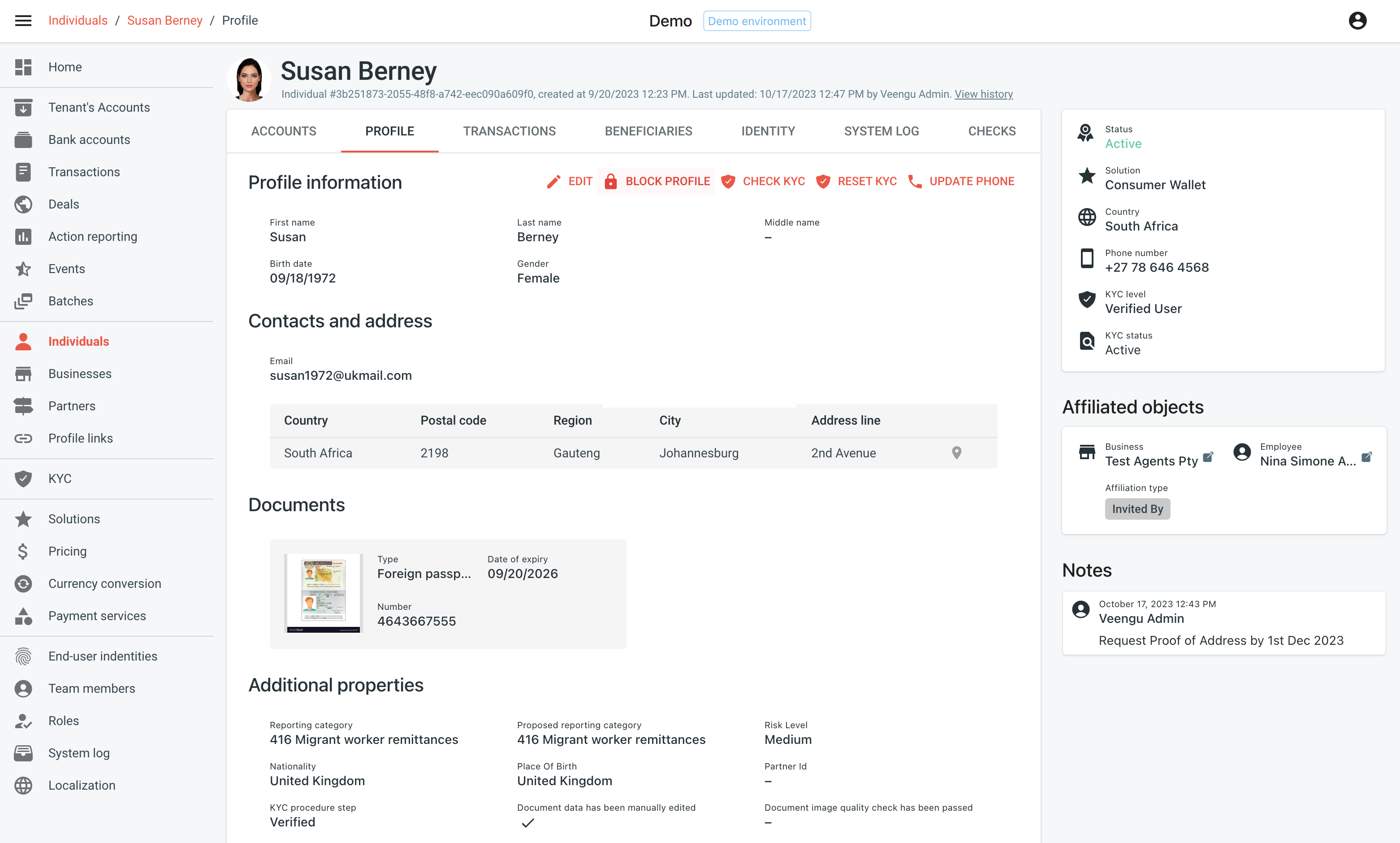

This component of Core Banking Software for Fintech stores comprehensive demographic information about each customer, including their personal details, KYC data, links to other objects, list of accounts, and other relevant data.

This module of Core Banking System for Fintech handles the creation, modification, and deletion of various types of accounts such as current account, wallet account, and other types of accounts.

This part of fintech core banking system manages the recording and processing of financial transactions, including deposits, withdrawals, transfers, and loan disbursements.

This component of Core Banking System for Fintech tracks all financial transactions and maintains a record of account balances for the bank. It ensures that debits and credits are accurately recorded.

This Fintech CBS’s component facilitates various payment methods such as electronic funds transfers (EFT), wire transfers, and other types of inward and outward transactions.

This component of fintech core banking system (CBS) helps in identifying, assessing, and managing risks associated with fintech service operations. It also ensures compliance with regulatory requirements and industry standards.

CRM tools help in managing customer interactions, tracking marketing relations, and maintaining relationships to enhance customer satisfaction and retention.

This component of core banking system for fintech enables customers to interact with the bank through various channels like online banking, mobile banking, WhatsApp bots, USSD, and physical branches.

It generates various reports for management, regulatory authorities, and internal stakeholders. These reports provide insights into the bank’s performance, customer behavior, and financial health.

This component includes features like authentication protocols, encryption, and access controls to protect sensitive customer data and prevent unauthorized access.

Ensures that the bank complies with legal and regulatory requirements, and generates reports for submission to regulatory bodies.

Allows for seamless integration with external services such as payment gateways, credit bureaus, and other financial institutions.

These components work together to form a comprehensive core banking system for fintech that serves as the foundation for a financial institution’s operations. They collectively enable the fintech service or bank to offer a wide range of services efficiently and securely.

Public and Enterprise (B2B) API with over 200 instantiated methods for managing users and services.

Secure Core Banking System deployment in Amazon (AWS) cloud or on-premise (cloud-agnostic)

Ready-made functional packages grouped into selectable and configurable features

Secure storage of personal data, access credentials management and audit trails

Scalable distributed architecture and a high-performing transactional engine

24/7 availability, simple setup provides up to 99.97% uptime

Core Banking System for Fintech by Veengu includes:

Core Banking System for Fintech by Veengu has the following technology foundation:

Core Banking System for Fintech by Veengu provides solutions for the following verticals:

Veengu empowers financial institutions with cutting-edge tech solutions, offering exceptional customer experiences, ultimate performance, and extreme scalability. Build unique fintech solutions across the world with our modular cloud-native platform.

Integrate financial services with embedded finance software platform. Create wallets, optimise cost of purchases and refunds, enable loyalty programs and more.

Statistics, analytics, reports about financial inclusion in the Middle East and North Africa. Current challenges and opportunities. Veengu software for fintech services in the MENA region.

Veengu cross-border transfer software covers multi-party orchestration, online currency conversion, compliance, risk management, white-label solutions – setting a new standard for efficiency and reliability in global transactions.