Embedded finance software platform

Integrate financial services with embedded finance software platform. Create wallets, optimise cost of purchases and refunds, enable loyalty programs and more.

We offer white-label fintech app solutions for both established enterprises and agile startups. Furthermore, our expertise extends to developing custom mobile banking apps with features such as mobile wallets, cross-border money transfers, and mobile money. This means that while you can begin with a standard white-label app, you have the flexibility to transition to a customized app later on.

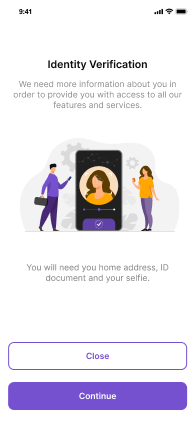

The white-label banking mobile app offers a customer self-onboarding feature that enables users to seamlessly sign up for banking services. This process includes initial authentication, capturing essential demographic details, ID information, taking a selfie, recording the user's address, and more.

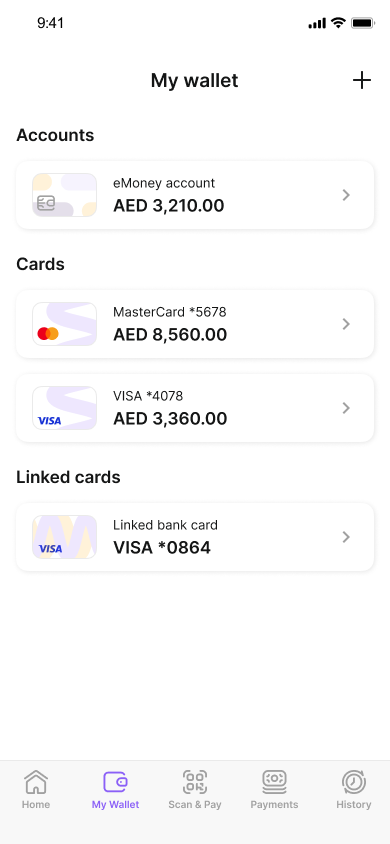

The white-label fintech mobile app grants users access to their accounts, cards, and various payment instruments. These instruments may be directly hosted within the Veengu core platform, while others are accessible through Veengu Account Orchestration. Users can view balances, check account status, and manage the lifecycle of their accounts seamlessly within the app.

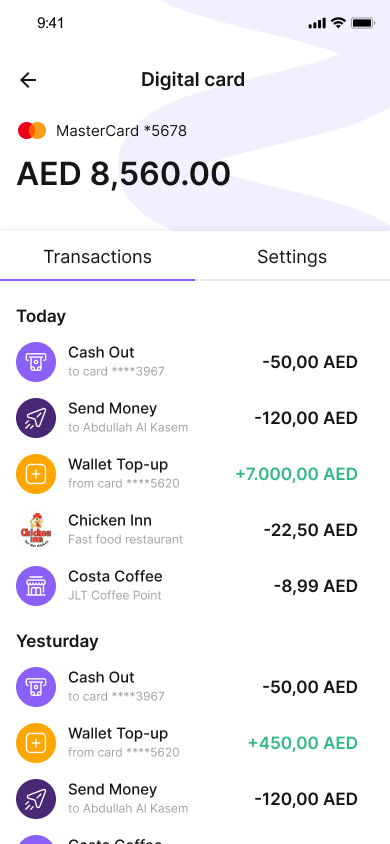

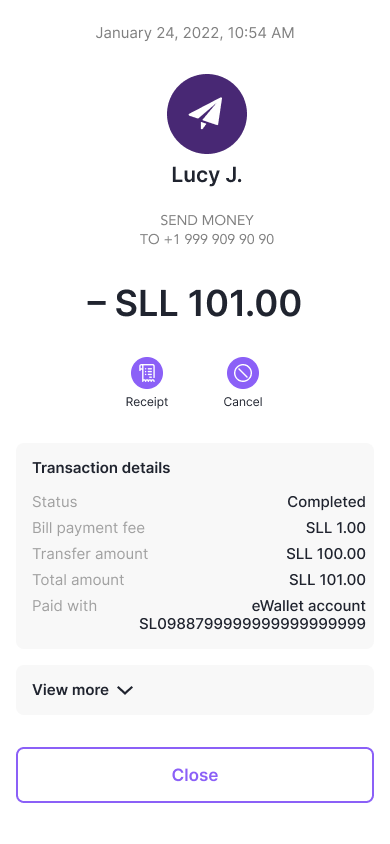

The Veengu white-label mobile app for digital wallets offers users a comprehensive overview of their transactions. This includes details on fees, information captured during transaction execution, and the option to easily share receipts with others.

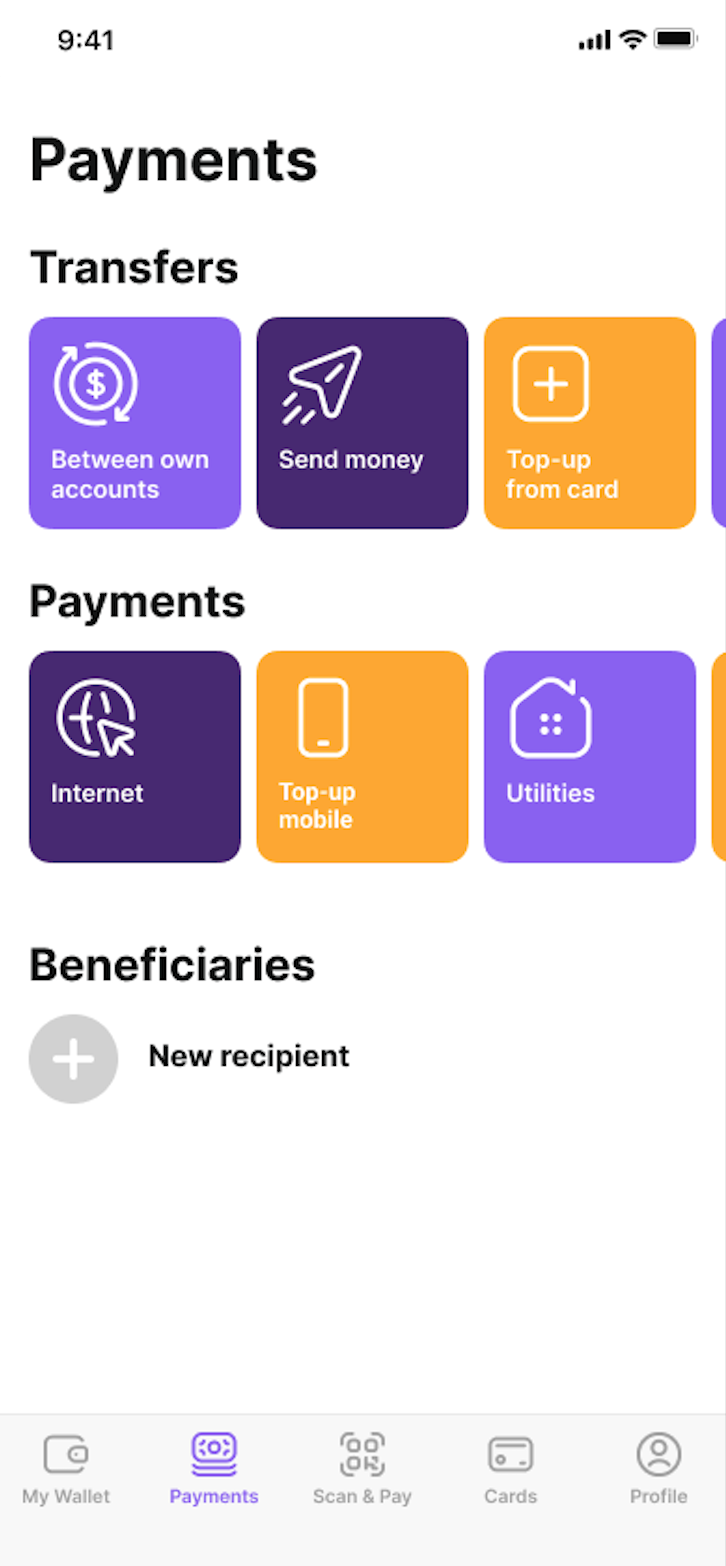

The Veengu white-label banking mobile app encompasses various financial transactions, including incoming and outgoing transfers, bill payments, cross-border money remittances, peer-to-peer transfers, payments to others, and value-added services.

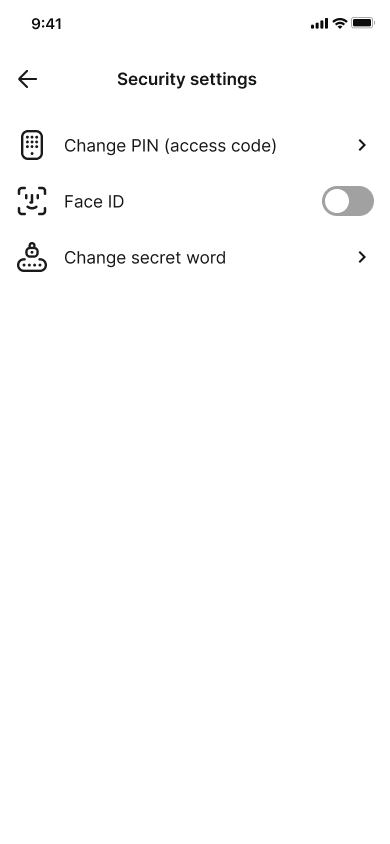

The white-label fintech mobile app offers multiple authentication methods, including one-time passwords (OTPs) sent via SMS, biometric authentication, and additional authentication through a static password (secret word).

The Veengu white-label banking mobile app enables users to make purchases using QR codes, which can be either static or generated dynamically by merchants in real-time. This feature provides users with a convenient and secure method of completing transactions using their mobile devices. Additionally, users can easily scan QR codes to initiate payments, enhancing the overall shopping experience.

The Veengu white-label digital wallet mobile app includes features for cash deposits and withdrawals. These functions empower fintech providers to launch a closed-loop banking service without the need for additional integrations. This capability allows end-users to gradually transition from cash to digital financial services.

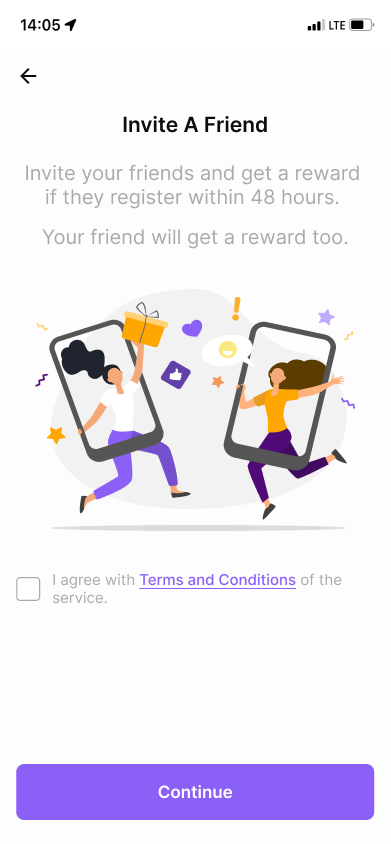

The Veengu white-label fintech mobile app incorporates additional marketing features such as "Invite a friend," loyalty rewards, and merchant rating capabilities. These features are designed to engage more customers and encourage long-term retention within the fintech service ecosystem.

Our comprehensive software suite, designed for different verticals in the financial services industry, is configurable to implement your vision with our platform and professional services.

Build unique fintech solutions across the world with our modular cloud-native platform.

Veengu white-label apps are built as cross-platform applications using the React Native stack, supporting both iOS and Android platforms.

The apps are published on Google Play and the Apple App Store under the accounts of our customers, not under Veengu accounts. You maintain full control over your apps.

You have the option to purchase the source code of the frontend apps and proceed with development and customizations entirely independently from Veengu at any time.

Veengu empowers financial institutions with cutting-edge tech solutions, offering exceptional customer experiences, ultimate performance, and extreme scalability. Build unique fintech solutions across the world with our modular cloud-native platform.

Integrate financial services with embedded finance software platform. Create wallets, optimise cost of purchases and refunds, enable loyalty programs and more.

Statistics, analytics, reports about financial inclusion in the Middle East and North Africa. Current challenges and opportunities. Veengu software for fintech services in the MENA region.

Veengu cross-border transfer software covers multi-party orchestration, online currency conversion, compliance, risk management, white-label solutions – setting a new standard for efficiency and reliability in global transactions.